Mobile-phones shipment in the domestic market in the 1st half of the FY 2011,Japan

November.01.2011

■The total shipment in the 1nd half of the FY 2011 increased to 20.28 million units, up by 6.0% over the last year.

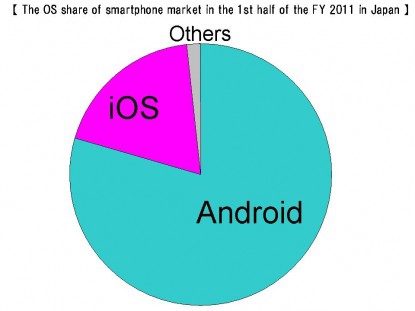

■The total shipment of smartphone in the 1st half of the FY 2011 is 10,04 million units. The 1st place is occupied by Android which was sold in a volume of 7.99 million units of which share is 79.6%..

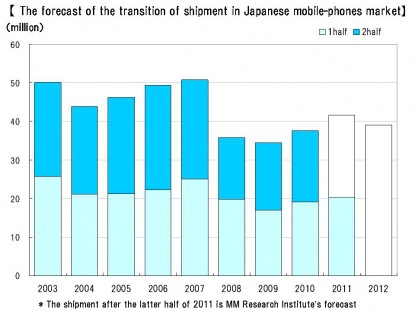

■MM Research Institute forecasts the shipment in the FY 2011 will reach 41.60 million units. The shipment of smartphone in the FY 2011 is 23.30 million units (56 percent of total shipment)

MM Research Institute (Tokyo, Minato-ku, the head manager, Hiroshi Nakajima) researched mobile-phones shipment in the domestic market in the 1st half of the FY 2011, from April to September.

As a result, the total shipment increased to 20.28 million units, up by 6.0% over the last year. The semiannual shipment has reached 20 million units for the first time since 25.63 million units were recorded in the 2nd half of the FY 2007. MM Research Institute analyses that a major reason for the increase in shipment is that the market was driven by stronger needs for smartphone. Another reason is that frequency band reorganization au has been promoting will spur replacement to the tri-band mobile-phones .

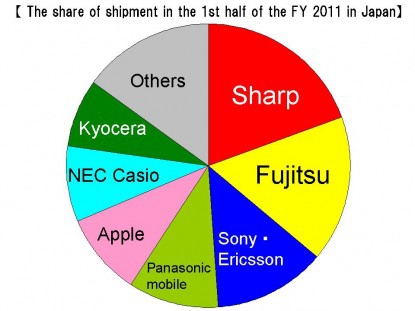

The smartphone shipment in the 1st half of the FY 2011 in Japan reached 10.04 million units. It is about 4.5 times as many as the last year, and accounts for 49.5% of the total shipments. According to the ranking by venders in the smartphone market, Sharp ranks the 1st place with 2.28 million units (smartphone market share 22.7%) and the ranking by OS shows that Android ranks the 1st place (79.6% of smartphone market share).

■Sharp ranks the 1st place in shipment in terms of volume in the mobile phone market as well as the smart phone market.

Sharp ranks the 1st place in the volume share of shipment by vender in the 1st half of the FY 2011. Sharp has maintained the 1st place for 11th consecutive periods since the 1st half of 2006. The volume of shipment is 3.94 million units (9.4% decrease compared with last year). The share downs to 19.4% with 3.3 point decrease over the last year. They also rank the 1st place in the volume share of smartphone shipment of which total is 10.04 million units. The volume of shipment is 2.28 million units with 22.7% share of the market.

Fujitsu (Fujitsu Toshiba Mobile Communications is included) ranks the 2nd place which is the same position in the last year. The volume of shipment is 3.38 million units (18.6% increase compared with the last year). The share slightly gained by 1.8 points compared with the last year to 16.7%.

Sony Ericsson Mobile Communications (Sony Ericsson) ranks up in the 3rd place from the sixth place of the last year. The volume of shipment is 2.60 million units (83.1% increase compared with the last year). The share is up by 5.4 points over the last year to 12.8%.

Panasonic Mobile Communications (Panasonic mobile) ranks 4th place. The volume of shipment is 2.09 million units with a 19.9% decrease compared with last year. The share fells to 10.3% (down by 3.3 points compared with the last year).

The fifth position is taken by Apple. The volume of shipment is 1.88 million units with a 40.3% increase compared with the last year). The share gains 2.3 points over the last year up to 9.3%.

NEC Casio Mobile Communications (NEC Casio) ranks the sixth place. The volume of shipment is 1.78 million units with a 22.9% decrease compared with the last year. The share declines to 8.8%with a 3.3 point decrease compared with the last year.

Kyocera ranks the seventh place. The volume of shipment is 1.59 million units with a 27.1% decrease compared with the last year. The share declines to 7.8%, (3.6 point decrease compared with last year).

■The total shipment of mobile phones in the FY 2011 will reach 41.6 million units. The total smartphone units will reach 23.3 million which represent 56.0% of the total shipment

Being accelerated by the shift to smartphones in the future, the volume of shipment is expected to reach more than 20 million units in the 2nd half of the FY 2011. MM Research Institute predicts the total shipment in the FY 2011 will reach 41.60 million units, up 10.5 percent compared with the last year.The volume of shipment will be over 40 million units for the first time in four years since the FY 2007. Concerning smartphone shipment, it will be 23.3 million units which will be expected to account for 56.0 percent of the total shipment.

■Sharp ranks the 1st place in the smartphone shares by vender. Android ranks the 1st place in the shares by OS.

Sharp also ranks the 1st place in the smartphone shares (SP share) as well as in the total mobile phone shares in the 1st half of the FY 2011.The total shipment of smartphone in the 1st half of the FY 2011 is 10,04 million units.

Smartphone shipment by Sharp, the top ranked, is 2.28 million units, of which share is 22.7%.

Sony Ericsson ranked the 2nd place. The volume of shipment is 2.23 million units, of which share is 22.2%. Apple ranked the 3rd place. The volume of shipment is 1.88 million units, of which share is 18.7%.

Fujitsu ranked the 4th place. The volume of shipment is 0.98 million units of which share is 9.8%. Samsung ranked the 5th place. The volume of shipment is 0.83 million units of which share is 8.3%. NEC Casio ranked the 6th place. The volume of shipment is 0.81 million units of which share is 8.1%.

Regarding the shares by OS, the 1st place is occupied by Android which was sold in a volume of 7.99 million units of which share is 79.6%. The second place was taken iOS which was sold in a volume of 1.88 million units of which share is 18.7%.

■Sharp also ranks the 1st place in the smartphone market.

Sharp has topped in the total mobile phone market for 11 consecutive semiannual periods. In the 1st half of the FY 2011, the shipment by Sharp is 3.94 million units, down by 9.4 percent over the last year and the share declines to 19.4%, down by 3.3 points over the last year. The shipment of smartphone is 2.28 million units, of which share is 22.7%.

Sharp is also at the 1st place in Japanese smartphone market. A major reason that Sharp ranks the 1st place is that Sharp has successfully developed the well-balanced distribution channels. For example, their main devices, “AQUOS PHONE” are sold to three main careers, and well-designed phones, “INFOBAR A01” are sold through au and popular among the au users.

■Fujitsu expands their shipment and share through the effective acquisitions.

Fujitsu occupies the second place which is in the same position of last year. Fujitsu’s shipment is 3.38 million units up by 18.6 percent and the share is 16.7%, up by 1.8 points. These figures include Fujitsu Toshiba Mobile Communications which was created in October 2010 by the acquisition of Toshiba's mobile phone business. In addition to phones with attractive features including "RakuRaku phone series" for DoCoMo, REGZA Phone "T-01C (DoCoMo)" and "IS04 (au)" were widely accepted. As a result, the shipment of smartphone is 0.98 million units of which share is 9.8%.

■Sony Ericsson advanced to the 3rd place thanks to Smartphone "Xperia"

Sony Ericsson advanced to the 3rd place thanks to the success of Smartphone "Xperia", of which series are widely accepted by the users. The shipment is 2.6 million units, up by 83.1 percent and the share is 12.8%, up by 5.4 points. A major reason for which they could advance is the success of “Xperia” series. In particular, Xperia acro "SO-02C (DoCoMo)" and "IS11S (au)" are very popular among the users. Their shipment of smartphone is 2.23 million units of which is 22.2% (Sony Ericsson ranks in the 2nd place in the smartphone share).

Panasonic Mobile ranks the 4th place. The shipment is 2.09 million units, up by 19.9 percent and the share is 10.3%, down by 3.3 points. Apple ranks the fifth place. The shipment is 1.88 million units with a big gain of 40.3 percent and the share is 9.3%, up by 2.3 points. NEC Casio ranks the sixth place. The shipment is 1.78 million units, down by 22.9 percent and the share is 8.8%, down by 3.3 points. Kyocera ranks the seventh place. The shipment is 1.59 million units with a big loss of 27.1 percent and the share downs to 7.8%, by 3.6 points.

■MM Research Institute forecasts the shipment in the FY 2011 will reach 41.60 million units (10.5 percent increase compared with last year)

In the 2nd half of the FY 2011, there are some terminals we should focus on such as the one equipped with the latest version of AndroidOS, iPhone which has started be sold by au, and DoCoMo's Next Generation smartphone corresponding to High-speed communications standard LTE (Xi). Further expansion of these smartphones and revitalization of the market due to competition between carriers are expected.

MM Research Institute forecasts the shipment in the FY 2011 will reach 41.60 million units (10.5 percent increase compared with last year) and the shipment of smartphone in the FY 2011 is 23.30 million units (56 percent of total shipment) This is 2.7 times compare with that of the last year. Smartphone shipment will take the majority in the mobile phone market with a number of 56% in the mobile phone market.

In the future smartphone market, durability of battery and operability in addition to the evolution of hardware and displays CPU and mew versions of OS will be keys to success. In recent years, the network has become increasingly important in the use of smart phones. So, mobile terminal manufacturers and carriers will need to improve faster transmission speed and network.

Contact US

MM Research Institute

Contact :

Address : The Front Tower Shiba Koen, 2-6-3 Shiba-Koen, Minato-ku, Tokyo 105-0011

TEL : 03-5777-0161